Are You Moving to a Real Estate Firm with a Firm E&O Policy? Is Your Firm Changing to a Firm E&O Policy? If So, Your Coverage May Be Affected

Rice Insurance Services Company, LLC (RISC) administers real estate licensee errors and omissions (E&O) insurance policies issued by Continental Casualty Company in the vast majority of states that require licensees to maintain such coverage. While policies administered vary from state to state, it is always important to understand how your coverage applies and what professional services it insures. Real estate E&O policies typically apply to claims made against an insured alleging a negligent act, error, or omission in professional services.

Most real estate E&O policies, including RISC’s policies, are claims-made-and-reported policies. Under any policy, critical aspects of coverage include who is an insured and what professional services are insured, which may vary depending on the type of policy. The nature of claims-made-and-reported policies and the differences between insureds and professional services under two common types of insurance policies can create coverage issues for licensees moving from an individual policy to a firm policy.

Determining Which Policy Applies to a Claim. Under claims-made-and-reported policies, coverage is typically reviewed under the policy in effect when the claim is first made, regardless of when the underlying professional services occurred. Changes in the persons or professional services insured from the time of the professional services to the date of the claim could impact coverage. Four dates are important in determining whether a claim may be covered under a claims-made-and-reported policy:

- The Date the Claim is First Made Against the Insured. Coverage is considered under the policy or extended reporting period (ERP or “tail coverage”) in effect when the claim is first made against the insured, even if a different policy was in effect when the professional services were performed. If no policy or ERP was in effect when the claim arose, then there is no applicable policy to potentially provide coverage for the claim.

If you do not renew your RISC policy for any reason, including because you are moving to a firm with a traditional firm policy or because your firm is changing to a traditional firm policy, you may want to consider purchasing an ERP endorsement to apply to claims that arise after your RISC policy’s end date and during the ERP. Additionally, the professional services giving rise to the claim must have been performed after the retroactive date and before the expiration of the last policy period. RISC offers ERP endorsements for a specific number of years, which must be purchased within ninety days of your last RISC policy’s end date.

- The Retroactive Date. E&O policies typically apply to professional services performed after the policy’s retroactive date, which may be determined differently under different policies. Under RISC’s policies, the retroactive date is established separately for each insured licensee. This is the date from which the licensee has continuously maintained uninterrupted E&O coverage. Any gap in coverage (break between the end of one policy period and the beginning of the next) terminates the previously-established retroactive date. The new retroactive date will be the date the licensee reestablishes coverage.

- The date of the professional services giving rise to the claim. The professional services giving rise to the claim must have occurred after the retroactive date for the policy to apply.

- The date the insured reports the claim to the insurance company in writing. The insured must report the claim in writing during the same policy period in which the claim first arose for the policy to apply. Insureds should immediately report any claim they receive to their insurance carrier in writing.

Under RISC’s policies, for a claim to be covered, the insured must have a policy or an ERP in effect on the date the claim is made, have had coverage on the date of the professional services, and have continuously maintained coverage between those two dates. Further, the claim must be timely reported to the insurance company.

Determining Who and What Professional Services are Insured. This may vary depending on the type of policy. Below are brief descriptions of two common types of real estate E&O policies:

- Issued to Individual Licensees, such as RISC’s Policies.

- Insureds: Individual licensees purchase coverage through RISC policies. Insureds include the licensee and any real estate firm the licensee represents for the firm’s vicarious liability for negligent acts, errors, or omissions in the licensee’s professional services (to the extent coverage would be available to the licensee).

- Professional Services: Those services included in the applicable state’s licensing law’s definition of broker or salesperson that require a real estate license. RISC’s policies follow the insured individual licensee, regardless of what real estate firm the licensee was associated with at the time of the professional services.

- Issued to Real Estate Firms (“Traditional Firm Policies”).

a. Insureds: The firm and the firm’s licensees, but only for the licensees’ professional services performed on behalf of the insured firm.

b. Professional Services: Professional real estate services performed on behalf of the insured firm. Traditional firm policies are unlikely to insure professional services provided before a licensee was affiliated with the insured firm, even if the claim is made during the traditional firm policy period.

Because claims often arise years after the subject professional services, traditional firm policies may present coverage issues for licensees who were previously on their own or associated with a different real estate firm.

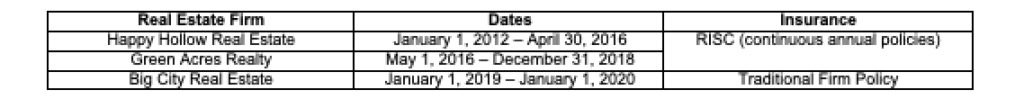

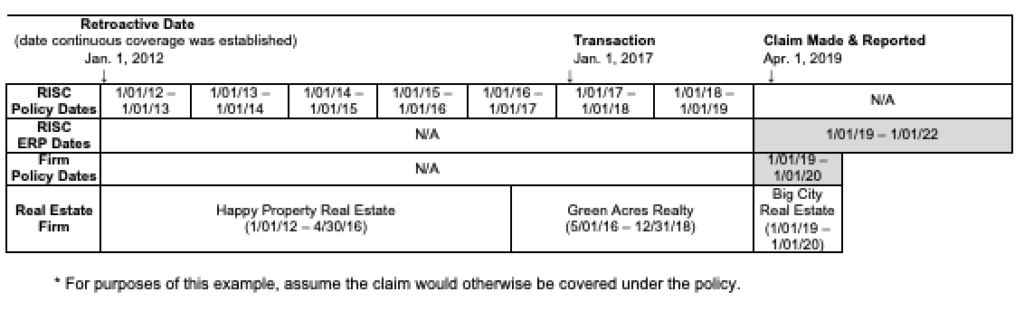

Example 1. Changing Real Estate Firms. Mr. Licensee worked with Happy Property Real Estate from the time he was first licensed on January 1, 2012 to April 30, 2016. On May 1, 2016, Mr. Licensee left Happy Property Real Estate and began working with Green Acres Realty, where he worked until December 31, 2018. Mr. Licensee maintained continuous coverage while he was with Happy Property Real Estate and Green Acres Realty by purchasing individual policies through RISC. Mr. Licensee’s last RISC policy expired January 1, 2019. On January 1, 2019, Mr. Licensee began working with Big City Real Estate. Big City Real Estate had coverage through another carrier’s traditional firm policy, which had effective dates of January 1, 2019 to January 1, 2020.

To help with the following examples, below is a summary of Mr. Licensee’s work and insurance history:

Example 1.A. Changing Firms While Maintaining Continuous Coverage with RISC – Coverage Applies.* While Mr. Licensee was with Happy Property Real Estate, he worked with a seller in a transaction that closed on December 1, 2014. On June 1, 2016, just a month after Mr. Licensee left Happy Property Real Estate, the seller made a claim against him. Mr. Licensee immediately reported the claim to RISC, his insurance carrier at the time the claim arose.

The claim was first made against Mr. Licensee on June 1, 2016, during the effective dates of his 2016 RISC policy, so that policy applied to the claim. That policy’s retroactive date was January 1, 2012, because that was the date Mr. Licensee first obtained E&O insurance and he had no gaps in coverage since that time. The professional services giving rise to the claim occurred on December 1, 2014, after the policy’s retroactive date. Additionally, Mr. Licensee timely reported the claim to RISC.

Because RISC’s policies are sold to individual licensees, the fact that Mr. Licensee changed real estate firms between the date of the transaction and the date of the claim does not affect coverage. Because Mr. Licensee had coverage with RISC when the claim was made, had E&O coverage at the time of the transaction, maintained continuous coverage between those dates, and timely reported the claim, it was covered.

*For purposes of this example, assume the claim would otherwise be covered under the policy.

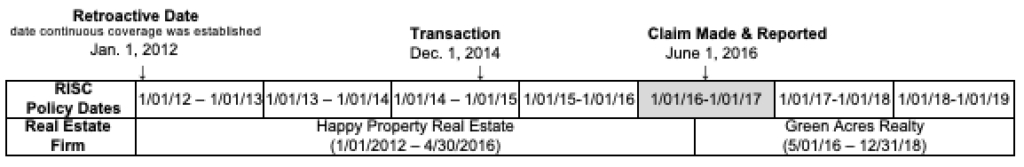

Example 1.B. No RISC ERP Endorsement When Moving to a Firm with a Traditional Firm Policy – No Coverage Applies. Mr. Licensee chose not to renew coverage through RISC when he moved to Big City Real Estate in 2019, because he believed he was adequately insured under the firm’s policy.

On April 1, 2019, a buyer that Mr. Licensee worked with while he was with Green Acres Realty made a claim against Mr. Licensee relating to a transaction that closed on January 1, 2017. Big City Real Estate’s traditional firm policy would be the most likely to apply, because it was the policy in effect when the claim arose.

Unfortunately, Big City Real Estate’s traditional firm policy only covered Mr. Licensee’s professional services performed while he was with Big City Real Estate, so that policy did not provide coverage for this claim involving his professional services with Green Acres Realty.

Disappointed, Mr. Licensee submitted the claim to RISC, thinking it may be covered because he had a policy with RISC at the time of the transaction. However, the RISC policy did not apply to the claim, because it expired before the claim was made and there was no ERP in effect. Therefore, Mr. Licensee had no coverage for this claim.

Example 1.C. Purchasing a 3-Year RISC ERP Endorsement When Moving to a Firm with a Traditional Firm Policy – Coverage Applies.* Instead of assuming he was adequately covered through Big City Real Estate’s traditional firm policy as he did above, Mr. Licensee purchased a three-year ERP endorsement from RISC within ninety days of his policy’s expiration date of January 1, 2019. The endorsement extended the policy’s reporting period by three years to January 1, 2022. When Mr. Licensee received the buyer’s claim on April 1, 2019, he immediately submitted it to both Big City Real Estate’s insurance carrier and RISC. Although there was no coverage under Big City Real Estate’s firm policy, there was coverage under Mr. Licensee’s last RISC policy, because the claim arose during the ERP. Additionally, the professional services occurred after the retroactive date and Mr. Licensee timely reported the claim to his insurance company.

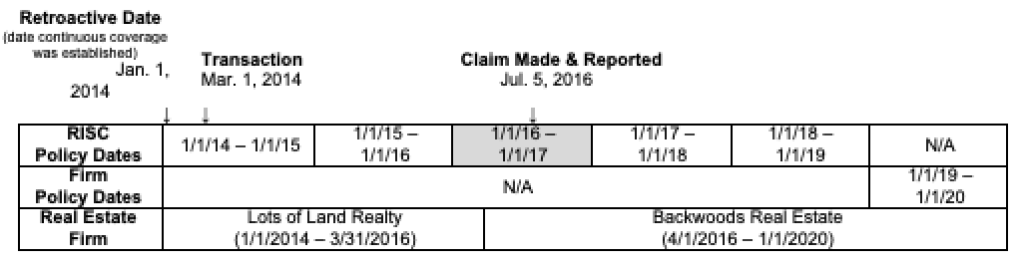

Example 2. Firm Changing to Traditional Firm Policy. Ms. Agent started her career with Lots of Land Realty on January 1, 2014. On April 1, 2016, Ms. Agent moved from Lots of Land Realty to Backwoods Real Estate, where she still works. While with Lots of Land Realty, Ms. Agent maintained uninterrupted insurance through RISC. When Ms. Agent first moved to Backwoods Real Estate, its licensees also maintained insurance though RISC, so Ms. Agent continued to renew her RISC policy. Shortly before the 2018 RISC policy was set to expire on January 1, 2019, Backwoods Real Estate told its licensees they no longer needed insurance through RISC, because Backwoods Real Estate was going to purchase a traditional firm policy with individual effective dates of January 1, 2019 to January 1, 2020. Ms. Agent’s last RISC policy expired January 1, 2019, and Backwoods Real Estate continues to maintain a traditional firm E&O policy.

Example 2.A. Changing Firms While Maintaining Continuous Coverage with RISC – Coverage Applies.* Ms. Agent closed her first listing on March 1, 2014, while she was with Lots of Land Realty and believed everyone was happy with the transaction. However, on July 5, 2016, after she had moved to Backwoods Real Estate, Ms. Agent was served with a lawsuit alleging she negligently represented her very first client. Ms. Agent immediately submitted the claim to RISC.

Ms. Agent’s 2016 RISC policy, with effective dates of January 1, 2016 to January 1, 2017 applied to the claim, because it was in effect when the claim arose. That policy’s retroactive date was January 1, 2014, because that was the first date Ms. Agent obtained E&O coverage and she continuously maintained coverage since that time. The professional services giving rise to the claim occurred on March 1, 2014, after the policy’s retroactive date.

Because RISC’s individual policies are sold to individual licensees, the fact that Ms. Agent changed real estate firms between the date of the transaction and the date of the claim does not affect coverage. Because Ms. Agent had coverage with RISC when the claim was made, had E&O coverage at the time of the transaction, maintained continuous coverage between those dates, and timely reported the claim, it was covered.

*For purposes of this example, assume the lawsuit arises to a claim that would otherwise be covered under the RISC policy.

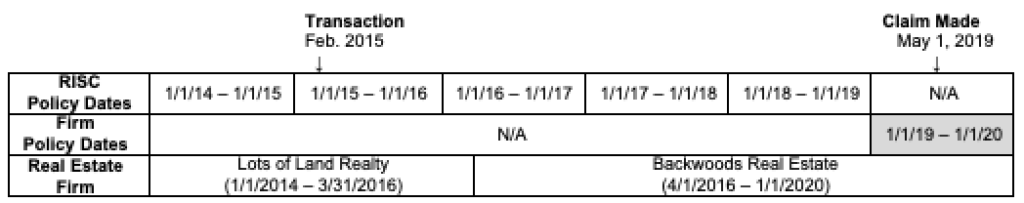

Example 2.B. No RISC ERP Endorsement When Firm Changes to Traditional Firm Policy – No Coverage Applies. On May 1, 2019, Ms. Agent received a demand letter from a client she worked with in February 2015, while she was associated with Lots of Land Realty. The most likely policy to apply to the claim would be Backwoods Real Estate’s traditional firm policy, because it was the policy in effect at the time the claim was made. However, that policy did not provide coverage for the claim, because it only applies to professional services performed on behalf of Backwoods Real Estate. It does not cover claims involving the professional services Ms. Agent rendered while she was associated with Lots of Land Realty.

Ms. Agent then submitted the claim to RISC, hoping there would be coverage, since she had insurance with RISC at the time of the transaction. Unfortunately, since there was no RISC policy or ERP in effect when the claim was made, Ms. Agent had no coverage for this claim.

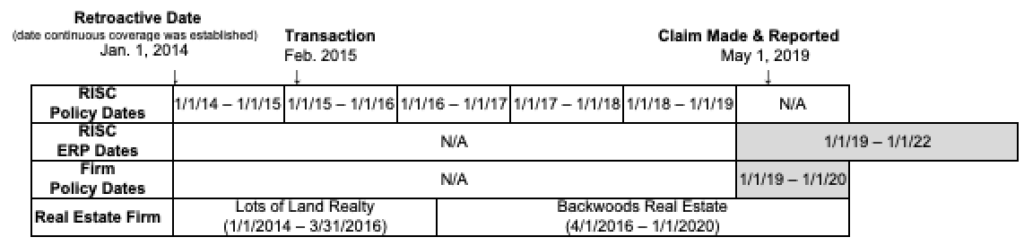

Example 2.C.Purchasing a 3-Year RISC ERP Endorsement When Firm Changes to Traditional Firm Policy – Coverage Applies.* Assume instead Ms. Agent asked her broker at Backwoods Real Estate and the firm’s insurance agent whether the firm’s new traditional firm policy would apply to professional services she provided before she joined that firm. When she learned it would not, Ms. Agent called RISC to see if there were any options for individual coverage. She learned that she may continue to renew her individual coverage through RISC as long as she has an active real estate license or that she may purchase an optional ERP endorsement within ninety days of the expiration of her last RISC policy.

Ms. Agent chose a three-year ERP endorsement, which she purchased within ninety days of the January 1, 2019 expiration of her last RISC policy. The ERP endorsement extended the policy’s reporting date to January 1, 2022. After receiving the demand letter on May 1, 2019, Ms. Agent immediately submitted it to RISC. Although there was no coverage under Backwoods Real Estate’s traditional firm policy, there was coverage under Ms. Agent’s last RISC policy, because the claim arose during the ERP, involved professional services performed after the retroactive date, and was timely reported.

*For purposes of this example, assume the claim would otherwise be covered under the policy.

Protect Yourself

If you have had individual coverage and are (1) moving to a firm with a traditional firm policy or (2) considering relying on the coverage provided by your firm’s traditional firm policy, talk to your broker or your firm’s insurance agent to determine if the traditional firm policy will cover professional services you performed while you were associated with another real estate firm. If not, you may want to consider continuing to purchase individual coverage (as long as you have an active real estate license) or purchasing an ERP endorsement. For more information, feel free to visit RISC’s website, www.risceo.com, or call 1-800-637-7319, ext. 1.

This information is for illustrative purposes only and is not a contract. Nothing herein should be construed as legal advice or advice regarding any applicable standard of care. Rather, this information is intended to provide a general overview of certain products, services, and situations encountered in the course of our business. This information does not amend any E&O policy in any way. Only the policy can provide actual terms, coverages, amounts, conditions, and exclusions. The program referenced herein is underwritten by Continental Casualty Company, a CNA insurance company. This information is for illustrative purposes only and is not a contract. It is intended to provide a general overview of the products and services offered. Only the applicable policy can provide the actual terms, coverages, amounts, conditions, and exclusions, which may be subject to change without notice. In the event of a claim, the nature and extent of coverage is determined based upon the claim’s facts, circumstances, and allegations and application of the relevant policy’s terms, conditions, and exclusions. The E&O program described herein is only available in certain states. CNA is a registered trademark of CNA Financial Corporation. Copyright © 2019 CNA. All rights reserved. Prepared by Rice Insurance Services Company, LLC © 2019